can you go to jail for not paying taxes uk

The maximum penalty for income tax evasion in the UK is seven years in prison or an unlimited fine. It rarely happens but its important to know the sorts of debt where this is a possibility.

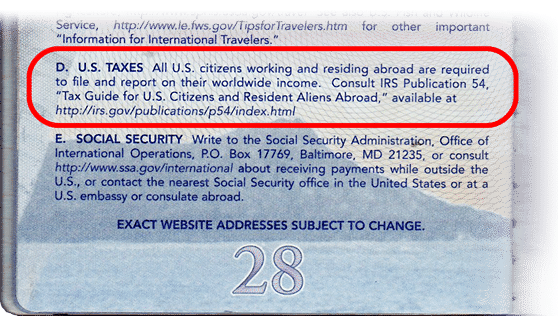

Not Filing Taxes While Living Abroad Here S What To Do

Scotland and Northern Ireland do not punish non-payment of local taxes with prison.

. The IRS doesnt pursue many tax evasion cases for people who cant pay their taxes. Heavy fines and even jail sentences can be possible for tax evasion on account of the maximum penalty. Providing false documentation to HMRC a summary conviction or via a magistrates court.

You can go to jail for lying on your tax return. Can You Go To Jail For Not Paying Taxes Uk. The period of time during which the evasion.

Other tax crimes arepunished as misdemeanors meaning that you could go to prison for up to a yearbe fined up to 100000 200000 if you run a corporation or both plus thecost of prosecution. Jail for Not Paying Civil Fines or Criminal Justice Debt. For further questions please share them in the comments section below.

HMRC estimates that 93 of tax due is paid and this is largely due to the fact that most people are taxed at source the correct sums are paid at the correct time automatically usually out of wages. Tax evasion as the name implies is the act of attempting to evade paying taxes. Filing a tax return that you know is not truthful is a felony and carries a prison term of greater than one year.

Yes you can be sent to prison for not paying tax. A person including a corporation who is unable to pay their debts which includes taxes as and when they fall due is bankrupt. If you file your return but cant afford the tax bill you wont go to jail.

The length of the sentence will depend on a number of factors including. If you dont have the money to pay court costs or fines the outcome depends on your state of residence. This goes without saying that you should still make it a point to file your returns and pay your taxes on time to avoid IRS penalties.

In fact you may be able to come up with an alternative arrangement with the IRS. Can you go to jail for not paying Council Tax UK. If the court decides you have something to pay back you may be able to make an arrangement to pay your debt over time.

You may even face wage garnishment or property seizure. You can be sent to prison for up to 3 months if the court decides you dont have a good reason to not pay your Council Tax and you refuse to do so. Remember that tax evasion was used to take down criminals such as Al Capone it is not.

Failing to file a tax return is a misdemeanor punishable by imprisonment for up to one year in jail. In short tax avoidance is merely legitimate tax planning. However if you do follow the law then you cannot be sent to jail for being bankrupt.

Where tax evasion does occur however it is dealt with. The maximum UK penalty is a fine for up to 20000 or a six months prison sentence. One who avoids tax does not conceal or misrepresent but shapes and pre-plans events to reduce or eliminate tax liability within the parameters of the law.

There are laws that deal with bankruptcy and they also have criminal sanctions including prison if you dont follow them. Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000. The IRS mainly targets people who understate what they owe.

England remains the only part of the UK where individuals can be sent to prison for not paying local tax bills. Taxpayers have the right to reduce avoid or minimize their taxes by legitimate means. The short answer is maybe.

ExciseRevenue fraud - Tax evasion. The amount of tax evaded. Dont file a required tax return.

Taxpayers can also go on a payment plan with the IRS to help pay off what they owe over time and depending on certain circumstances penalties and interest on taxes owed can be waived Cawley said. Absolutely yes you can go to jail for not paying your taxes. Generally speaking tax evasion is not a common problem.

Oftentimes youll be subject to tax penalties which will run you a pretty penny at up to 50 of your unpaid tax amount. However if you fail to file at all or inaccurately report your taxable income with the intention of not paying all taxes due you may certainly be put in jail. A summary conviction is subject to a maximum fine of 5000 or 6 months in jail for those convicted of income tax evasion.

Avoidance of tax is not a criminal offense. The actor Wesley Snipes and Leona Helmsley being only among the more notable of the m. Not paying your taxes is a non-jailable offense if purposeful tax evasion has been ruled out.

Crown Court cases can be a maximum of seven years in prison or an unlimited fine. But you wont go to jail. Tax evasion sentence A summary conviction can be for 5000 or six months in jail.

This may have you wondering can you go to jail for not paying taxes. However you cant go to jail for not having enough money to pay your taxes. Both a fineand imprisonment plus the prosecution costs.

But if you conceal assets and income that you. Tax evasion can put you in prison for up to five years. You can go to jail for not filing your taxes.

You cannot go to jail for not being able to pay but you can go to jail for ignoring the court. Tax evasion penalties apply when its a summary conviction and is carried out within 6 months or if its a fine the length of the jail term plus the fine. Yes but only in very specific situations.

Tax evasion cases mostly start with taxpayers who. In the United Kingdom all income tax evaders are prohibited from serving. The maximum sentence for tax evasion in the UK is seven years and an unlimited fine.

The maximum penalty for income tax evasion in the most serious cases is a seven year prison sentence or an unlimited fine. About a hundred people a year are sent to prison for council tax arrears here is a case where a mother was in prison for 40 days before being released. The short answer is.

This includes any action that is taken specifically to avoid the assessment of taxes like filing a fraudulent return. Where over a period of time an offender has evaded tax they must not only pay the tax and pay a financial penalty but a custodial sentence should also be imposed. What Happens If You Get Caught Not Paying Taxes Uk.

About 30 people a year go to prison for not having a TV licence although new sentencing guidelines in 2017 should. Cheating public revenue due to the serious nature of the crime the maximum. Tax evasion is the deliberate non-payment or underpayment of tax by individuals or businesses that is legally due to HMRC.

Fines for tax evasion are usually heavy in the UK and jail time for offenders is possible if you are caught red-handed. Making an honest mistake on. Misreport income credits andor deductions on tax returns.

To better understand these distinctions take a closer look at when you risk jail time for failing to pay your taxes.

How Legally Hide Your Money From The Government Mybanktracker

Who Goes To Prison For Tax Evasion H R Block

How Will The Irs Contact Me Amy Northard Cpa The Accountant For Creatives Small Business Tax Deductions Business Tax Deductions Small Business Tax

Infographic What Can The Irs Do To You Business Tax Tax Preparation Irs

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Remember Taxes Are Due On The 15th Of July This Year Don T Wait Until The Last Minute To Get Them Done And Be For Income Tax Humor Taxes Humor Tax Time

How Do I File Taxes If I M Paid Under The Table Amy Northard Cpa The Accountant For Creatives Rechtsformen Einkommensteuer Tipps

Decided I Will No Longer Be Paying Taxes What Are They Gonna Do Tax Me More Go Ahead I Won T Pay Those Either Oh I M Going To Prison The One Paid For

The Woman Jailed For A 4 742 Council Tax Debt She Could Not Pay Council Tax The Guardian

No It S Not Your Money Why Taxation Isn T Theft Tax Justice Network

Monopoly Fun Facts Fun Facts Intresting Facts Facts

What Would Happen If Citizens From A Country Stopped Paying Taxes How Would This Affect The Local And Global Economy Quora

It Is Important To Understand That Tax Planning Tax Structuring And Tax Avoidance Are All Perfectly Legal Tax Evasion Is Not Tax Haven Investing Books Books

Meet The People Who Refuse To Pay Their Taxes By Mary Finn The Bold Italic

Some People I Swear Accounting Humor Accounting Jokes Taxes Humor

Wesley Snipes Who Was Jailed For Failure To File Taxes Claims Trump Avoided Tax Because Of Who He Knows The Independent